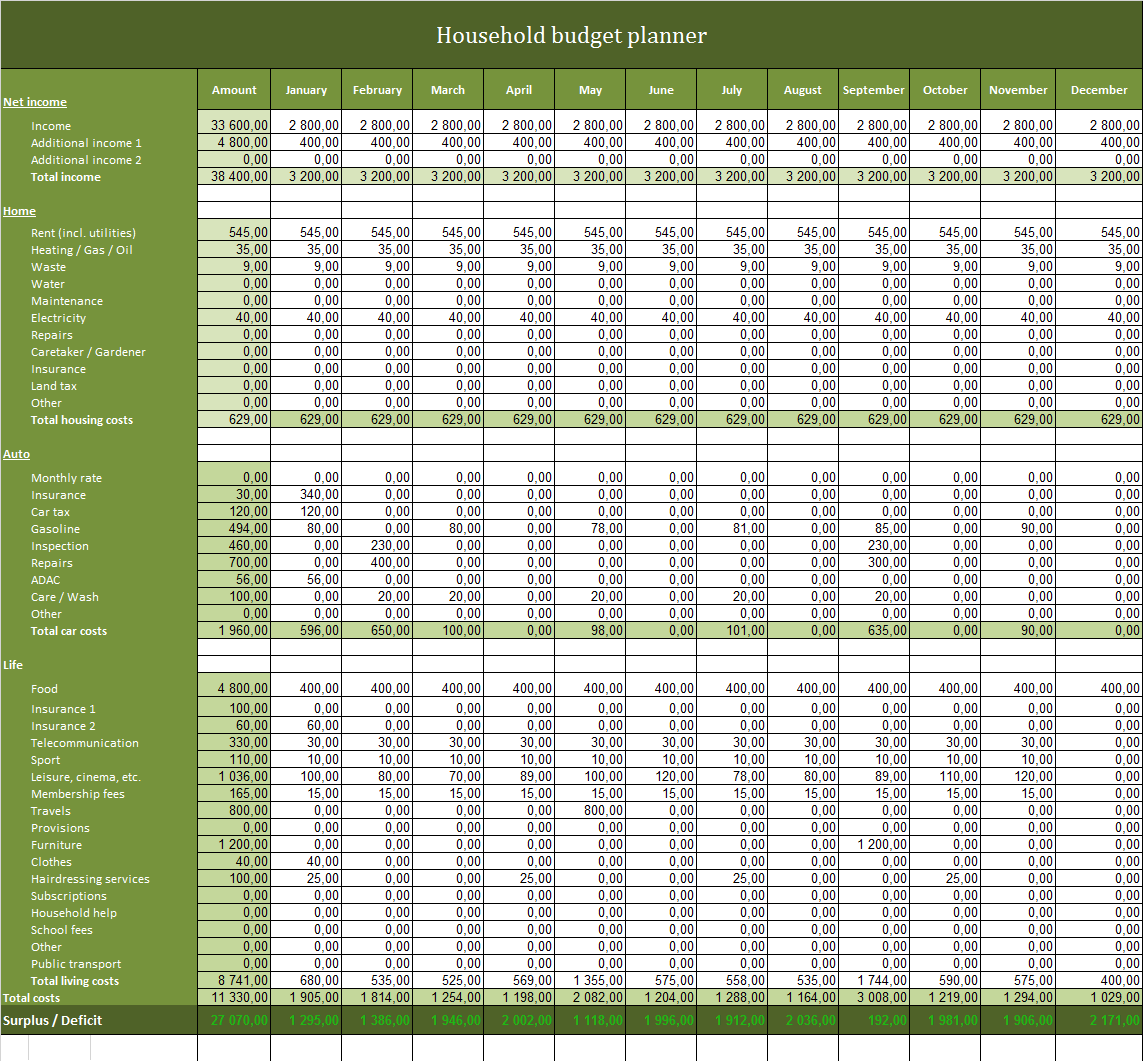

Check out the “expense tracker” part of our budget template to complete this step. groceries, bars, restaurants, shopping, gas, Uber).

Try using categories to keep it organized (e.g. Third, it’s time to track your variable spending going forward. Second, input your bills and fixed expenses (think rent or mortgage, phone bill, utilities, car payments or insurance, and Netflix), as well as any savings or debt payments you’re currently making regularly.

#Excel budget workbook how to

What if you don’t know how to make an excel spreadsheet, you ask? We’ve already created a budget template for you! (Fill in your email at the bottom of this article to receive the Ultimate Budget Template). If your income is variable, average your last few months and err on the side of caution. This will give you a solid birds-eye view of where and how you spend.įirst, record the amount of your monthly paycheque after tax deductions. Try tracking your expenses in real-time and updating your budget on a daily or weekly basis. If you like to keep close tabs on every one of your hard-earned dollars, you’ll want a more hands-on approach to budgeting. There are a few different ways to create a budget, which depend on your goals and personal preferences. How to find a budgeting strategy that works for you You’re now sharing expenses with someone - time to budget as a couple You’re saving up for something specific and large (for instance, if you’re hearing wedding bells.) You buy a house, or your rent significantly changes You have (or are thinking about having) a kid You’re going back to school, or have just graduated from school You should probably get reacquainted with your financial picture in the following cases: (That promotion you got might mean you can bring your fluffy little bernedoodle home sooner!) Why? Because whenever your income or expenses change, your path to your life goals also change. That said, it’s extra wise to make a budget anytime you have a life change. There is literally no ‘bad’ time to take stock of what you’re earning, spending, and saving. In our not-so-humble opinion, we think anytime is a good time to make a budget. Giving you the tools to save up for something specificĪnd, just in case you need a tad more convincing, there’s this little nugget from Andrew Hallam’s timeless investment guide, Millionaire Teacher: people who create a budget and automate their savings, save twice as much as people who don't. Helping you feel in control of your spending Showing you where your paycheque goes every month Even someone who is wealthy can feel uncomfortable spending money if they don’t have a good grasp of their financial picture.

#Excel budget workbook free

In Shannon Lee Simmons’ highly readable book, Worry Free Money, the financial planner writes that “unless you know what you can afford, everything feels expensive.” Paying attention to how you spend gives you the security and freedom to pursue your goals, guilt free. Budgeting is a tool that you can whip out time and time again to bring order to that chaos. No matter where you are in life and what you have on the horizon, feelings of financial anxiety can (and often will) creep in.

If you’re one of those rare humans who are naturally frugal and already adept at saving, creating a budget can reassure you that you’re on the right track. Creating a budget is a great way to build a lifestyle that allows you to get where you want to go, and a system that keeps you accountable to your plan. Maybe your values include being debt-free by age 30, or saving up enough to buy an irresistibly adorable bernedoodle. Put very simply, a budget is meant to do only two things: (A) Ensure you’re not accidentally going into the red, and (B) Align your spending with your values. So, let's go over the steps to getting your financial life in order and creating a budget that works for you. Think of it like Marie Kondo’ing your finances-something you can do today to help quell your money anxieties and you know, spark more joy in your life. If you want to keep buying jojoba beard oil, go right ahead! A budget’s job is to help you organize your finances so that you can do more of what you want to do in life and stop having nightmares about never ending credit card statements. But it doesn't have to be that way! In fact, the purpose of a budget is not to make you feel bad about the way you spend your money. The term “budgeting” can be a bit scary because it conjures up images of 10-tabbed excel spreadsheets designed to make you feel guilty about every dollar you're spending. So, we created our own template that’s easy to fill out and gives you a bird’s-eye view of your finances. But, after scouring the internet, it’s clear there aren’t that many templates out there that actually work.

0 kommentar(er)

0 kommentar(er)